We explain the difference and our approach to posting journal entries

Bookkeep's technology is built around Generally Accepted Accounting Principles (GAAP), a set of guidelines put forth by the Financial Accounting Standards Board (FASB). We maintain this GAAP standard by embedding accrual accounting practices within our automation software.

Under accrual accounting, revenue is recorded when it is earned and expenses are recorded when they are paid. This practices helps bookkeepers create an accurate overview of business finances. Accrual accounting practices are preferred by business owners who wish to better manage debts, taxes, future earnings, and net revenue in real time.

The alternative accounting practice (which is not in line with GAAP) is cash-basis accounting. Cash accounting simply records revenue and expenses at the time when cash is received or paid out. Despite this being the easier of the two methods, this often distorts financial results given that it only tracks financial activity when money exchanges hands.

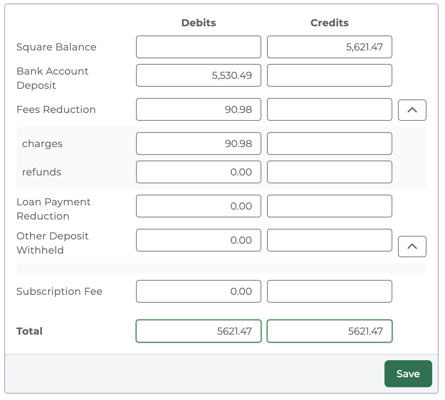

One of Bookkeep's core principles is to help businesses make sense of their deposits. For example, under accrual accounting practices, a deposit is not revenue. The proper formula for a deposit is as follows:

sales revenue + sales tax + shipping income + gift card liability

- processing fees - loan withholdings

= deposit to your bank

For more information on how Bookkeep can help you make more informed financial decisions, please visit our website and start a free trial today.