Journal Entry Lines: Categories versus Subcategories

This is to help explain the lines found in a journal entry template mapping to ultimately post an entry to your accounting platform

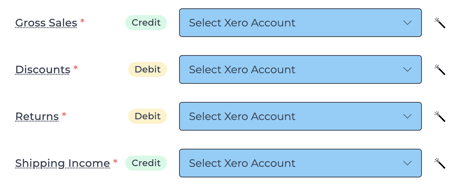

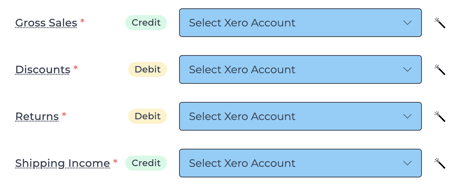

- When completing the account mapping to accounting for the first time after connecting accounting and your source system integration (e.g. Shopify) you see what we consider categories e.g. Sales, Discounts, Taxes, Expected Payments, etc.

- These categories are required to be mapped or else the posting will not post to an accounting platform

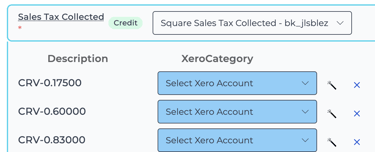

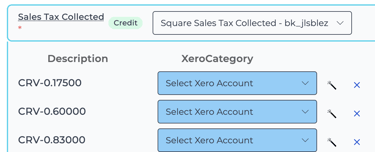

- Subcategories are unique to your account and change over time (see below where sales tax collected is the category with various subcategories beneath it):

- These are influenced by your source system e.g. Shopify provides sales categories which populate here

- The decision on whether to map subcategories is up to you as the entity owner as subcategory mapping is optional except in the case of Canadian sales tax as mentioned below

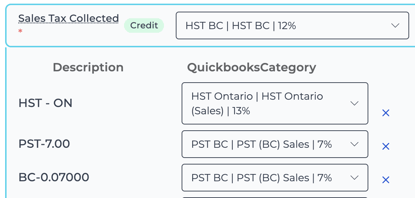

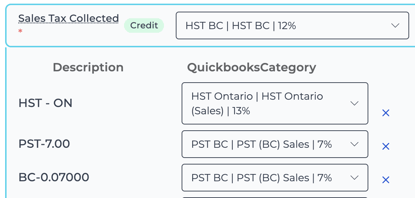

- The one exception is Canadian sales tax subcategories which are required for QuickBooks to enable correct tax reporting. If Canadian sales tax is enabled for QuickBooks Online, a journal entry posting can fail if not all tax subcategories are mapping similar to below:

- Over time, you will potentially see new subcategories

- Subcategories can be coming in over time based on the source system

- Some users choose to fully map every category and subcategory

- The decision on subcategory mapping is up to you as the entity owner

- Subcategories:

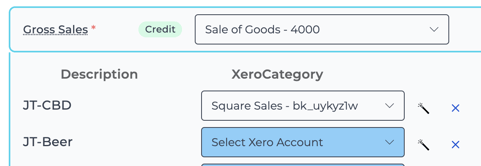

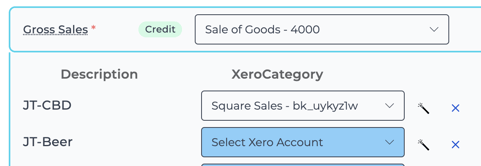

- These roll up into a category which means the sum of the subcategory amounts must equal the amount at the category level

- For example, if subcategory 1 is $50 and subcategory 2 is $60, this means that the category amount must be $110

- In the example below, the JT-CBD subcategory line will post to the Square sales account mapped. However, the JT-Beer subcategory is not mapped and the amount in this line will sum into the Gross sales category and post to the Sale of Goods account:

-

- If a user chooses not to map subcategories, they roll into the category amount and post to the category mapped account. Otherwise the amounts in the subcategory line will post to the mapped account for the subcategory