How Bookkeep posts financial data to QuickBooks Online as Journal Entries

Bookkeep is a powerful tool designed to streamline your financial processes by automating data entry tasks. By integrating with various platforms, Bookkeep can effortlessly fetch your financial information and seamlessly transfer it into QuickBooks Online as organized journal entries. This automation not only saves you valuable time but also eliminates the need for manual data input, reducing the risk of errors and ensuring accurate financial records.

To better understand this, let's look at the common journal entry types we post to QuickBooks Online. Depending on the specific integration e.g. Shopify, Stripe, Square, we offer various journal entries that we can post daily if you map them and turn them on.

The most common journal entries we sync to QuickBooks are:

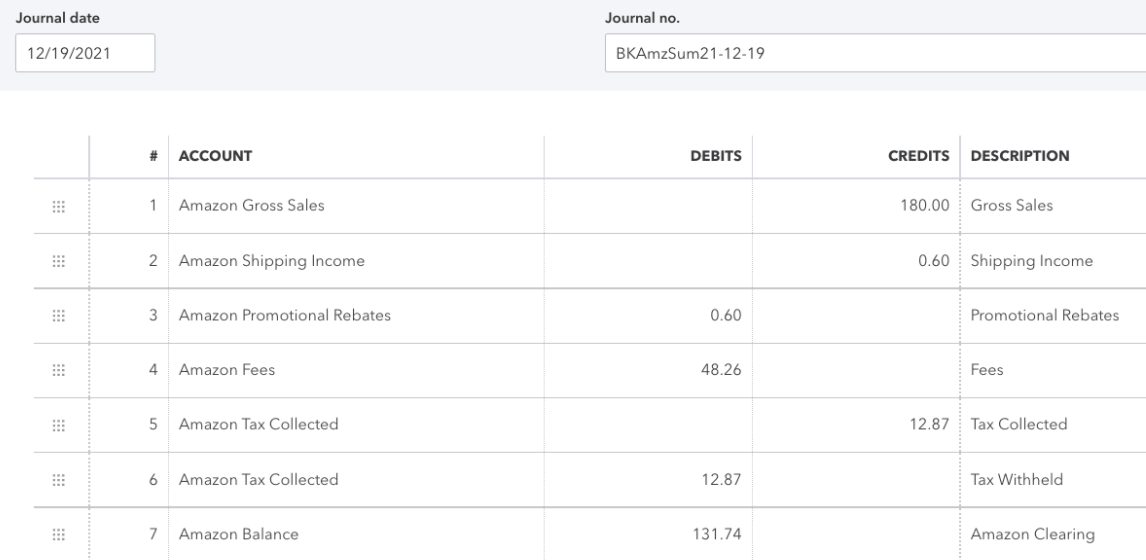

- Sales Summary - for daily sales, we post one journal entry that represents a day of sales per currency. Instead of bringing in every single order as a unique journal entry, we post one summarized journal entry representing a day of sales. See below for an example journal entry:

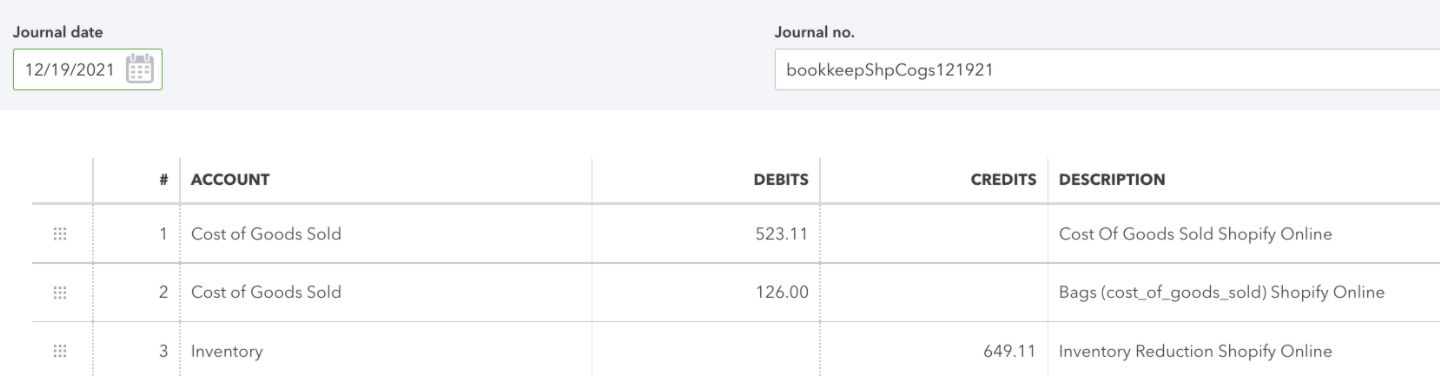

- Cost of Goods Sold (COGS) - the COGS entry represents the cost of goods that were sold for an entire day which increases the cost of goods account and decreases inventory since these items were sold. Again, we do not post each order as a separate journal entry, but we post one summarized COGS journal entry for a particular day. See below for an example:

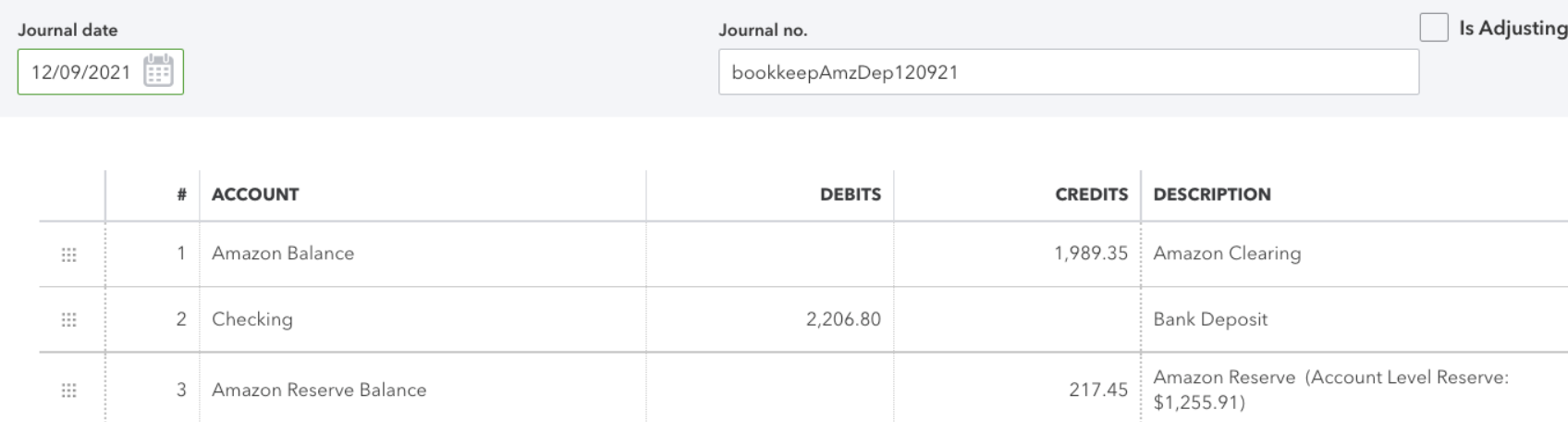

- Bank Deposits or Payouts - when it comes to deposits to your bank account, Bookkeep does not combine these into summarized journal entries. Bookkeep posts each deposit separately to allow you to easily match the deposits to your bank statement or bank feed. See below for an example:

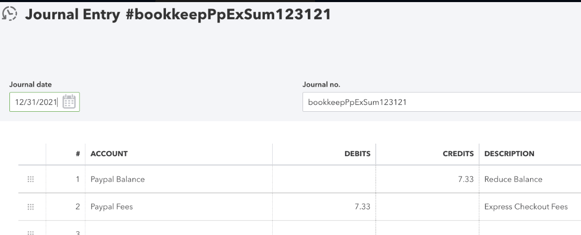

- Fees - Bookkeep posts fees as one summarized journal entry for a particular day. We do not post each fee transaction as a separate journal entry. Fee journal entries occur when you would like to book only fees related to most commonly payment processing. For example, if you have a Shopify store, but PayPal processes these sales, you would have Shopify post the sales journal entries. PayPal would incur fees to you for processing those sales and that is what the fee journal entry accomplishes. See below for an example:

As always feel free to reach out if you have any questions!