Here we explore best practices and tips on how to easily transition to using Bookkeep for accounting automation

As you embark on the migration to Bookkeep, it is essential to follow best practices and tips that we have gathered through assisting customers like yourself. A crucial step in this process is connecting your ecommerce and POS apps with your accounting platform. These apps play a vital role by providing data that we then convert into journal entries on your accounting platform.

This integration process is key to ensuring a smooth transition to Bookkeep. By linking these apps, you enable the seamless flow of financial information, allowing for accurate and efficient bookkeeping. As a result, you can have a comprehensive overview of your business's financial activities and performance.

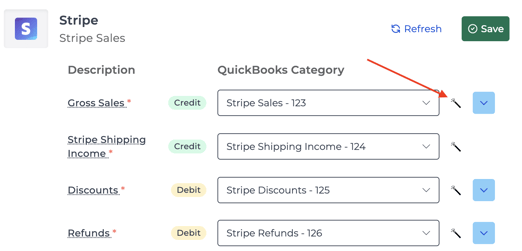

Initial Mapping to Accounts in your Accounting Platform

When setting up your initial mapping, you need to consider whether to create new accounts (which Bookkeep is able to do using the magic wand as shown below) or use existing accounts.

Using new accounts when setting up your initial mapping provides you with the advantage of easily tracking what Bookkeep has posted from the cutover date onwards. By utilizing the magic wand feature to create accounts, you will automatically generate our recommended accounts with the appropriate account type, such as "Other current assets" for a balance account. This streamlined process ensures that your financial data is accurately categorized and organized, facilitating a smoother transition to Bookkeep.

Previous Balances

Whether you opt for creating new accounts or using existing ones, it's essential to have all financial transactions, including sales and deposits, posted up to the transition date. For instance, if you begin recording sales with Bookkeep on January 21, ensure that sales from January 20 and earlier are already accounted for to avoid any missing data.

It is crucial to be mindful of any previous balances in your accounts when transitioning to Bookkeep. For instance, you might have recorded sales before using Bookkeep, but the corresponding deposits may occur after you start using the platform. In such instances, Bookkeep will post the deposit for sales that took place before you began using the platform. To ensure proper reconciliation, make sure to record these sales and deposits that occurred before using Bookkeep before posting any entries. This will help in reconciling any expected deposit amounts when the first deposit occurs with Bookkeep.

Example:

- January 20 - sales for $200, and therefore an expected deposit of $200 exists in your balance account in your accounting platform

- January 21 - start using Bookkeep

- Bookkeep records sales and deposits moving ahead

- January 22 - deposit for the $200 posted by Bookkeep

- Prior balance of $200 in expected deposits is reduced to $0 since Bookkeep posted the deposit

Tender Type Accounts

When integrating your apps with Bookkeep, you may encounter various payment tender types like cash, Paypal, or checks. To streamline your bookkeeping process, it is beneficial to create separate accounts for each tender type in your accounting platform. This practice simplifies monthly reconciliation tasks and ensures accuracy in tracking your financial transactions.

Summary

We are here to help with your transition to Bookkeep. Each situation can be unique, but overall we recommend having your books up to date when starting with Bookkeep to ensure prior sales and other financial events are already posted to ensure a seamless onboarding. If you need any help, free to contact support@bookkeep.com.