How to use Intra-App clearing accounts to reconcile DoorDash, UberEats, and Grubhub to your POS platform.

If you are like most restaurants 30% or so of your business is done using online delivery marketplaces like UberEats, DoorDash or Grubhub.

Most likely you are pulling those orders into your POS system in order to print the order to the kitchen so it's ready for pickup by the delivery person.

But how do you know that the financial details are being moved into your books properly?

Let's look at an example of how to use Intra-App clearing accounts to reconcile your POS system sales to your online sales.

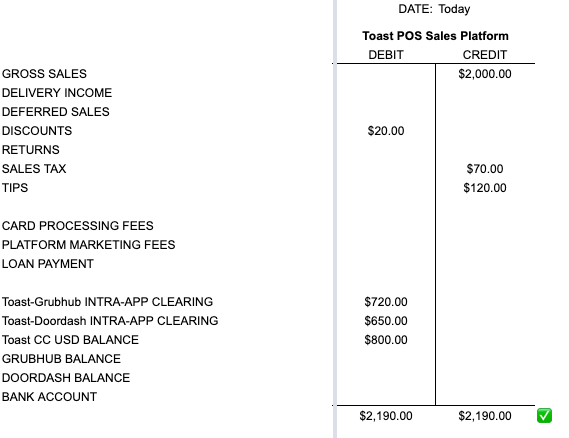

Say you are using Toast as the POS system and today you sold $2000, with orders from both Grubhub and DoorDash. The summary entry might look like this:

The above journal entry shows how to book revenue for the sales against payments expected in the future from Grubhub, DoorDash, and Toast payments.

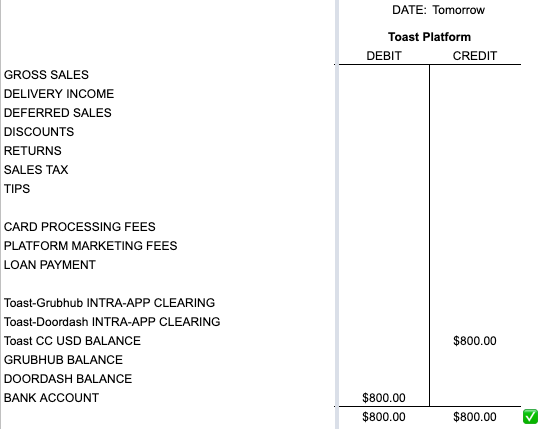

We book the money expected from toast payments to a BALANCE account because Toast POS and Toast Payments are the same company we expect that amount to be deposited eventually. That entry looks like this:

Easy right? We expect Toast to deposit that amount into our checking account (I am ignoring fees with Toast in this example).

The issue is with the delivery app importing orders into your POS system. There are many reasons why this information gets corrupted:

- Price differences on the online platform from your POS can cause reporting issues. (Hamburger on DoorDash costs $18 but in store costs $15, which price is used for reporting?)

- Returns and cancellations are not reported to the POS system.

- All the fees from online platforms don't make it to the POS system.

- Delivery income charged on the online platform is not sent to the POS system.

For these reasons we use an Intra-App Clearing account to reconcile what Toast POS knows to what DoorDash knows.

The key thing to note when using Intra-App clearing accounts is not to double book revenue.

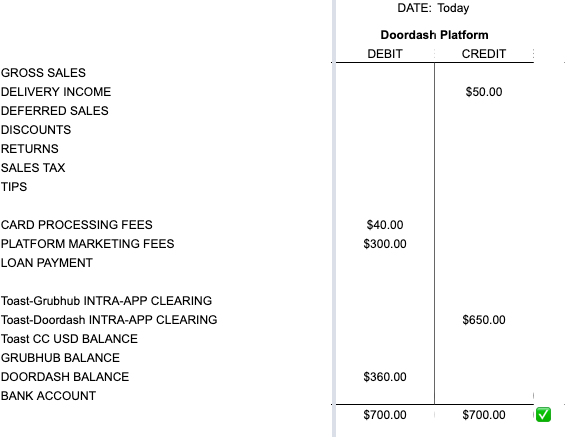

Once we get the file from DoorDash, Bookkeep automatically creates a journal entry that looks like this:

We book what DoorDash considers revenue to the Intra-App clearing but separately book Delivery Income to an income account.

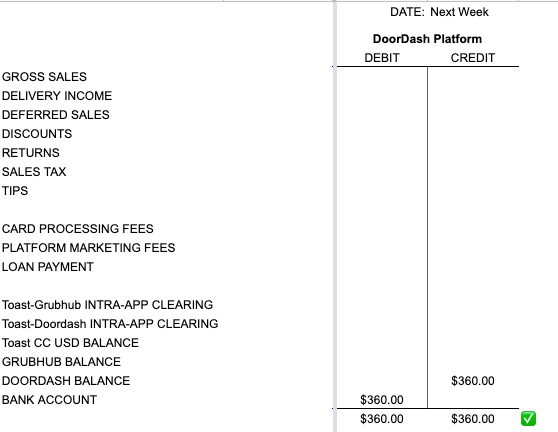

Then we also book all the fees to proper accounts. The rest goes to the DoorDash Balance account waiting for the payout to the Bank. The bank deposit becomes a simple transfer from DOORDASH BALANCE to BANK ACCOUNT:

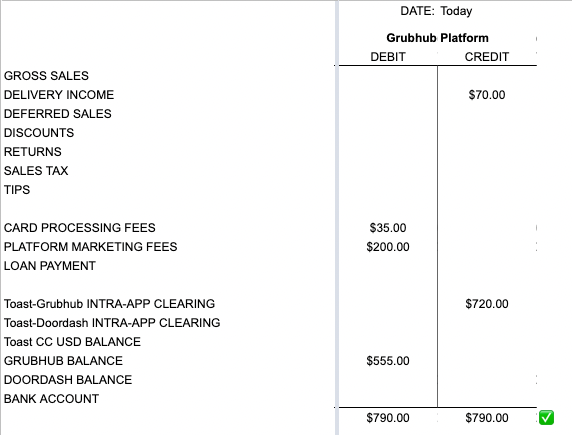

Similarly for GrubHub, our automation will book a daily entry that looks like this:

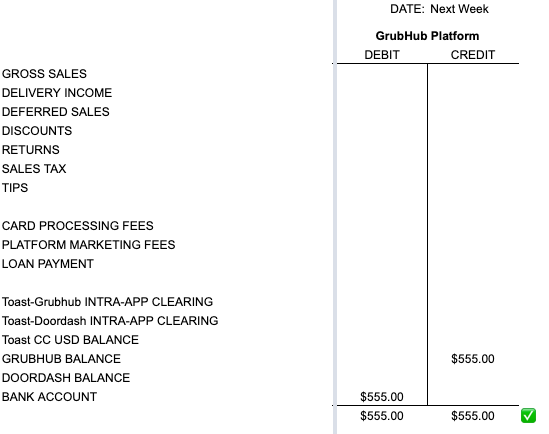

Where the revenue lines are mapped to the Intra-App clearing and the delivery income is booked to an Income Account. When the money from GrubHub hits your bank account on Wednesdays (and also the last business day of month) it looks like a simple transfer from GRUBHUB BALANCE to BANK ACCOUNT:

At the end of the month you need to reconcile the Intra-App clearing accounts and offset any unbalanced amount to Income. This would represent errors in income reporting between your POS and the Online Platform.

Of course Bookkeep automates all of this and we can even help you get started with the proper chart of accounts and mapping. We are here to help.