How Bookkeep handles complex accounting with Shopify deferred revenue and fulfillment-based revenue recognition

Bookkeep's Shopify integration provides seamless connectivity between your Shopify store and accounting platform. This integration includes an Ecommerce journal entry feature that automatically records daily sales data from the previous day into your accounting system. This ensures that your financial records are always up-to-date and accurate, without the need for manual data entry.

However, for more complex entities, booking sales prior to fulfillment does not meet their accounting revenue recognition requirements.

This led to the development of Bookkeep's Shopify Fulfillment Revenue Recognition Journal Entry. This entry supports entities that require revenue recognition upon fulfillment of an order.

Below, we will explain how this process of financial data flow operates. You will need the Ecommerce entry and Fulfillment Revenue Recognition entry working in parallel to capture the deferred revenue first and the revenue once fulfilled:

1. The Ecommerce Journal Entry:

This entry captures all sales, including discounts and refunds, to calculate the net sales amount. It also categorizes payments based on tender type, such as Shopify payments, third-party gateways, Paypal, and gift cards. Additionally, it accounts for any pending payments from completed orders, which may result in accounts receivable. Below is an example mapping:

In the case of the entity recognizing the revenue when an order is fulfilled, this journal entry would be ON with the GROSS SALES, DISCOUNTS, AND SHIPPING INCOME lines mapped to their deferred revenue account. Since it is not gross sales yet, the gross sales line maps to deferred revenue.

2. The Fulfillment Revenue Recognition Journal Entry:

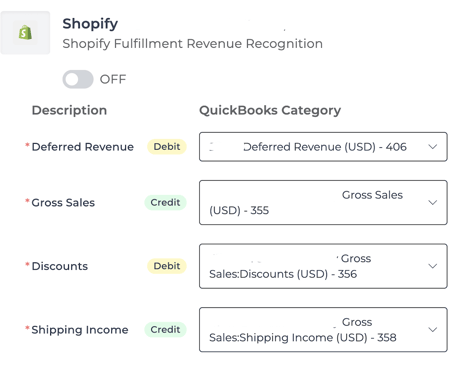

This captures orders that have been completely fulfilled allowing the entity to move the gross sales, discounts, and shipping income from deferred revenue into their respective accounts. This recognition is not done until an order is completely fulfilled. Below is an example mapping:

With the above workflow, Bookkeep can allow complex entities to properly book deferred revenue until the order is completely fulfilled to then recognize it as revenue.

The key with the mapping above is the deferred revenue account from the Fulfillment Revenue Recognition journal entry should also be used to map on the Ecommerce journal entry for the gross sales, discounts, and shipping income lines.

**NOTE: The fulfillment revenue recognition template does not capture refunds that were fulfilled. We capture all refunds fulfilled and unfulfilled on the ecommerce template. Therefore, we recommend adjusting your gross sales for any fulfilled refunds to capture the reduction in sales due to refunds of fulfilled line items.

How to tie out the Fulfillment Revenue Recognition Journal Entry:

The first step is to export orders from Shopify for the respective time period.

Here is an article on exporting orders.

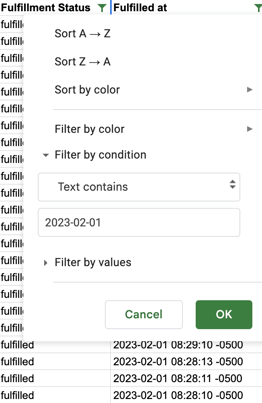

Once this is done, you will see a column for Fulfillment Status and a column for Fulfilled At. You can filter the status column to Fulfilled only and use the "text contains" filter for the Fulfilled At column for the date you wish to review e.g. 2023-02-01:

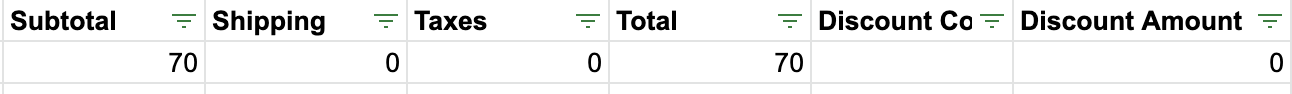

You can then sum the subtotal column and the discount amount column together to calculate gross sales for the day based on fulfilled orders:

Summing the shipping column will give the shipping income recognized for that day. Finally, summing the discount amount column will give the discounts total for the day.

This will allow you to verify everything ties out. If you have any questions, contact support@bookkeep.com.

NOTE: To utilize this fulfillment based revenue recognition process, you must be on the Plus Plan or higher.