Here we discuss the journal entries available for Squarespace

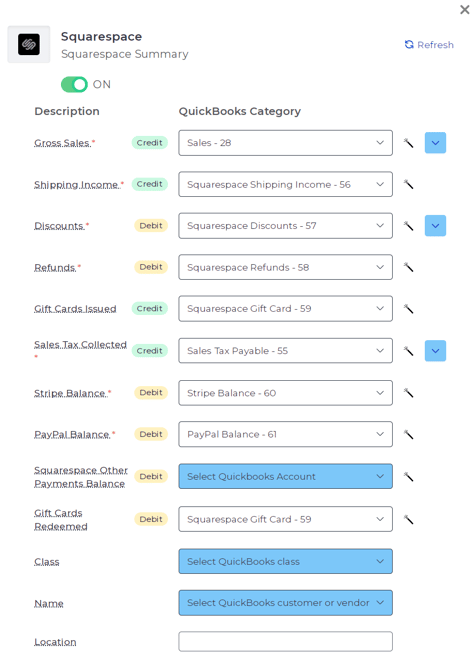

Bookkeep enables you to integrate your Squarespace account to automate journal entry postings.

The Sales Summary journal entry posts to your accounting platform on a daily basis the sales from the prior day. This aims to capture the gross sales down to the net sales including refunds, sales tax, gift cards sold and redeemed, etc., as well as payment tenders (Stripe, PayPal, or Other). See below for an example mapping.

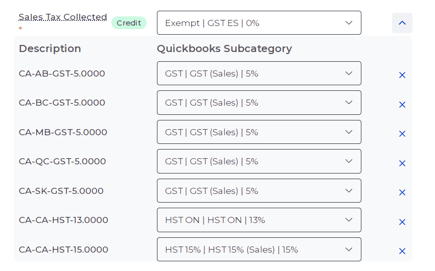

Note: For Canadian customers we have the ability to map to specific QuickBooks Online tax rates for Sales Tax reporting purposes.

Note: If you use Stripe and/or PayPal as your payment processors for Squarespace sales we recommend you use Bookkeep's Stripe and/or PayPal integrations (depending on your needs), which will automatically record on a daily basis your payment processing fees, bank transfers to and from these processors, loan payments etc. Otherwise you will need to manually record any fees and additional activity from your payment processors with the frequency desired.

If you have any questions regarding our Squarespace journal entry templates or for any guidance on your specific setup (highly recommended if using Stripe and PayPal as well) , feel free to reach out to support@bookkeep.com.