How to reconcile payments between sales platforms and payment platforms such as Stripe, Paypal, Sezzle, and Amazon Pay.

Ecommerce accounting is complicated because we have to manage multiple sales platforms and multiple payment platforms. And sometimes a payment platform acts like a sales platform (PayPal and Stripe, for instance).

When dealing with payment platforms that are also sales platforms, we have a situation where we need to reconcile payments from the sales platform to payment platform but also post sales to the payment platform.

Confusing, I know, so let's get specific:

If you are using WooCommerce as your sales platform and taking payments with PayPal and Stripe (a very common example), you are using WooCommerce as your sales platform and PayPal and Stripe as payment methods.

But, you could also create sales on PayPal and Stripe that are additional sales and not reported in WooCommerce.

In addition, we have seen from experience that you cannot just trust the sales platform to give you accurate information on payments collected. Put another way, if WooCommerce said they collected $100 using a PayPal payment method we need to verify that PayPal agrees with that amount.

The complexity comes not just from the above but also from timing. WooCommerce might be reporting in one time zone and PayPal in another time zone. This makes reconciliation extremely difficult.

How do we reconcile?

The way to handle a complex setup of sales platforms and payment platforms is to have Intrer-App clearing accounts. These are different from a Balance Account because a Balance account represents your balance with that payment platform (say, Stripe or PayPal). And, the payments done in that payment method on your sales platform are only PART of the picture.

Put another way, you can use PayPal or Stripe as a payment method on many sales platforms. The amounts transacted on one platform aren't the entire picture for PayPal or Stripe for that day.

We handle this with a new other current asset type account which is an inter-app clearing account. This clearing account should always net out to $0 over time depending on time zones and if it doesn't, we know there is an issue to research between the sales platform and payment platform.

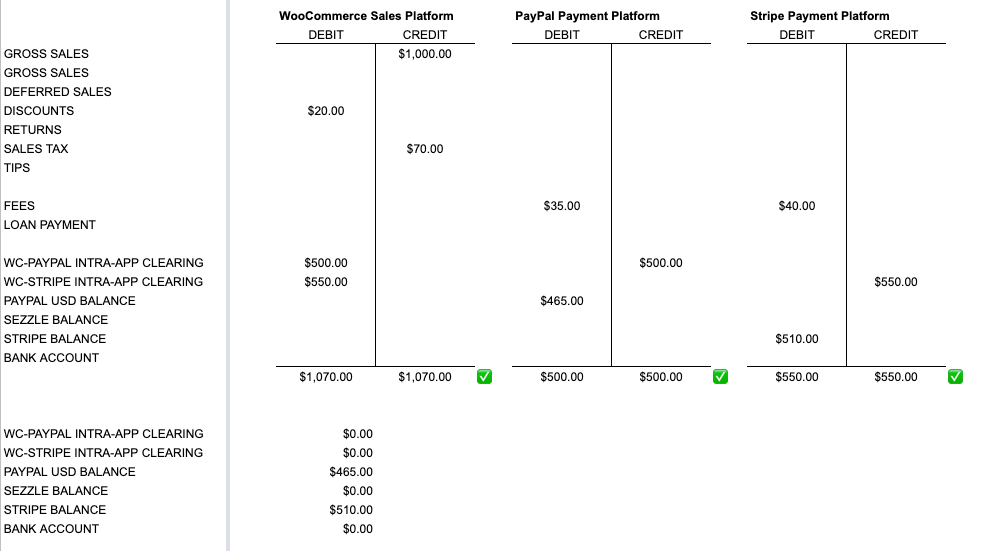

See below for an example of how we would book 3 journal entries on the same day to reconcile this situation:

So, if you are using WooCommerce with PayPal you need to create an Other Current Asset type account called WC-PayPal Inter-App Clearing. Then, in your WooCommerce sales summary journal entry, you should map sales processed by PayPal to that account.

On your PayPal Payments Received template, you will then map your "Express Checkout Payments" to the WC-PayPal Inter-App Clearing account as well because express checkout is what PayPal calls transactions done on WooCommerce and Shopify.