This article answers many of the questions surrounding Bookkeep Sales Tax, which automatically sets aside sales tax daily into an escrow account, then remits and files it when due.

Q: How do I access Bookkeep Sales Tax?

A: Bookkeep Sales Tax is available for any existing Bookkeep entity located in the United States. If you're new to Bookkeep, you can sign up today.

Please note that Bookkeep Sales Tax only supports Square, Mindbody, and Shopify at the moment. In order to get started, you first need to connect a valid Mindbody, Square or Shopify account to your Bookkeep entity.

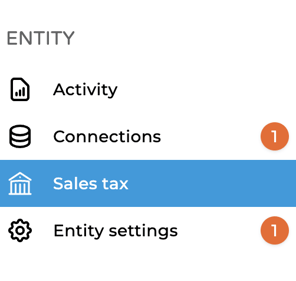

If you meet these requirements, you can access Bookkeep Sales Tax via the "Sales tax" page on your side navigation:

Q: How do I begin setting aside tax dollars?

A: After accessing the "Sales tax" page, you'll be presented with a brief overview of our Bookkeep Sales Tax feature. If you wish to move forward, you can click the "I'm interested..." button to either schedule a demo or an onboarding session (if you're ready to move forward).

**Please note you will not be billed for this feature until after your onboarding session is complete.**

Q: What do I need in order to set up Bookkeep Sales Tax?

A: During your onboarding call, you'll be required to provide the following information so we can begin setting aside tax dollars the following day:

1. Login credentials for the state(s) Department of Revenue websites.

2. Additional information based on your state(s)

3. Account and Routing numbers for your ACH account

Q: When will Bookkeep begin collecting my sales tax?

A: Bookkeep Sales Tax will begin daily set asides after you add banking information to DAVO's sales tax portal.

Q: When does Bookkeep Sales Tax collect my sales tax?

A: Bookkeep and DAVO collect on a daily basis. Bookkeep fulfills your legal obligations daily; keeping sales tax revenue separate and secure from your general operating funds. We ensure the set aside funds are always available when Bookkeep remits sales tax revenues to the state.

Q: Will my sales tax funds be secure?

A: Bookkeep and DAVO fulfill all of your fiduciary responsibilities to the State by holding your sales tax funds separate from your general operating funds in a secure tax holding account at Wells Fargo Bank.

Q: Will Bookkeep Sales Tax calculate the sales tax on every item or tell me if an item is taxable?

A: No. Bookkeep and DAVO do not calculate or determine the taxability or tax rates of the items you sell. It is imperative that you have your Point of Sale (“POS”) system or Accounting Software package programmed with the correct tax rates so that we provide accurate information to the State when filing your tax returns. Bookkeep Sales Tax will collect, file and pay the amount of sales tax based upon the data retrieved from your POS or Accounting Software package. If you have questions regarding tax rates or taxability, please consult your tax professional or state department of revenue for advice. Please see DAVO's Terms and Conditions for tax liability responsibilities.

Q: How do I know that Bookkeep Sales Tax has filed my sales tax on time and in full?

A: You will be notified by email when Bookkeep and DAVO have completed your sales tax filing. You will receive a copy of your sales tax return as well as a time-stamped confirmation of payment.

Q: Will Bookkeep or DAVO defend me if I have a State Sales Tax audit?

A: No. Bookkeep and DAVO will provide you with electronic records of all your State Sales Tax filings. Most states will use your POS and/or Accounting Software systems and your transactional data for an audit.

Q: What are Bookkeep and DAVO responsible for in the case of an audit?

A: Bookkeep and DAVO are responsible for anything related to the Sales Tax Return formatting, filing on time and sale tax liability payment. The customer is responsible for the accuracy of the data.

Q: Does Bookkeep or DAVO Sales Tax file an annual report on my behalf?

A: No, Bookkeep and DAVO do not provide a record of sales. Annual reports are your responsibility. We suggest you review your POS documentation for that information. You can find a record of your sales tax filings done by DAVO on the Merchant Portal.